Tuesday 31 March 2015

Adapting to digital consumer decision journeys in banking

A host of emerging technologies are poised to personalize consumer experiences radically. Here’s how banks can prepare.

February 2015 | byEdwin van Bommel and David Edelman

Many banking executives are feeling immense pressure to devise the perfect customer experience—an experience that takes advantage of digitization to provide customers with cross-channel, targeted, just-in-time product or service information in an effective and seamless way.

This pressure is justified. During the next three to five years, we’re likely to see a radical integration of the banking experience across physical and virtual environments. As more consumers use mobile phones, tablets, and other digital devices to make basic financial transactions, some banks have responded by bulking up their websites and revamping traditional channels such as physical branches and call centers to support their digital efforts, reducing costs along the way. But in a world where consumers have endless online and offline options for researching and buying new products and services, all at their fingertips 24/7, digital channels no longer just represent “a cheaper way” for banks to interact with customers. They are now critical for executing promotions, stimulating sales, and growing market share. (For more, see the original article from which this piece is drawn, “Digitizing the consumer decision journey.”)

At a practical level, banks must also acknowledge the growing number of companies that are incorporating within their buying experiences payment processing and other financial services that have traditionally been solely in banks’ domain.1 Some online retailers, for instance, are experimenting with presenting short-term loan options to customers during the decision journey to support potential purchases—entirely feasible given the speed with which online lenders such as Kabbage and Lending Club can now provide underwriting services. These channels will never be able to offer the full range of services that banks do, of course, but the financial institutions that fail to account for this trend risk losing at least some of their customers to these upstart funding providers.

It’s not surprising that some banks could be lulled into thinking they’re already doing everything right. Many know how to think through customer search needs, for instance, or have ramped up their use of social media. Some are even “engineering” advocacy—creating easy, automatic ways for consumers to post reviews or otherwise characterize their engagements with the bank. Yet tools and standards are changing faster than banks can react. Customers will soon be able to search for financial products by image, voice, and gesture; automatically participate in others’ transactions; and find new opportunities via devices that augment their reality. How banks engage customers in these digital channels matters profoundly—not just because of the immediate opportunities to convert interest to sales, but because two-thirds of the decisions customers make are informed by the quality of their experiences all along their journey, according to research by our colleagues.2

To keep up with rapid technology cycles and improve their multiplatform marketing efforts, banks need to take a different approach to managing the consumer decision journey—one that embraces the speed that digitization brings and focuses on capabilities in three areas:

Discovery. Banks must apply advanced analytics to the large amount of structured and unstructured data at their disposal to gain a 360-degree view of their customers. Their engagement strategies should be based on an empirical analysis of customers’ recent behaviors and past experiences with the bank, as well as the signals embedded in customers’ mobile or social-media data.

Design. Constant product pushes wear thin upon repeated messaging, and consumers now have much more control over where they will focus their attention. Banks need to craft a compelling customer experience where all the interactions are expressly tailored to a customer’s stage in the decision journey. The bank should always be able to recommend the customer’s right next best action.

Delivery. Periodic marketing campaigns will always be core to banks’ customer-outreach programs, but more and more institutions are shifting their dollars to “always-on” marketing programs, in which banks engage with customers in exactly the right way at any contact point along the journey. This approach requires agile teams of experts in analytics and information technologies, marketing, and experience design. These cross-functional teams need strong collaborative and communications skills and a relentless commitment to iterative testing, learning, and scaling—at a pace that many banks may find challenging.

Using a hypothetical example, let’s consider what an optimized cross-channel experience could look like when banks target improved capabilities in these three areas.

Example: The new normal

Diane is on a business trip. She lands at Chicago’s O’Hare Airport and walks through the terminal toward the gate for her connecting flight to Toronto. As she passes a billboard for her bank, she receives a text message offering her a credit card upgrade, one with better travel perks than the one she has. When she opens the message, she is led to a customized web page that provides a benefits-based comparison of her existing card and the new one the bank is recommending. She simply needs to tap an “apply” button to start the purchase process. When she does, another message appears prompting her to take and upload a “selfie” so the bank can authenticate her.

The card is added to her mobile wallet, and Diane is given the option of making it her default payment method for any of the top ten online merchants she deals with. She selects seven of the ten, and within minutes of completing the task, she receives a message from the bank thanking her for her response and offering her an online coupon for a free drink from Chicago Coffee Roasters, a regional chain that happens to have a stand only two gates from where Diane is waiting for her flight.

Once in Toronto, Diane grabs a cab to the office. As she approaches the downtown area, she spots something and asks the driver to slow down; she uses her Property Spotting mobile application to upload a picture of a commercial building that is leasing office space (Diane’s company may be relocating some functions outside the United States). The app provides relevant details about the property—price, layout, amenities—and a direct link to the broker’s office. From within the app, Diane can click through to information from her bank about the area’s real-estate trends, such as recent sales and rentals and mortgage rates (her company has been exploring the potential bottom-line effects of different leasing and purchasing options). Soon after, a financial adviser from the bank sends Diane an e-mail message asking if she would like to schedule an appointment to talk about financing options and setting up a cross-border bank account. When they connect by phone later that afternoon, Diane has already been sent a link to a potential financing model for her reference during the discussion. The next day, on her way home, Diane gets a text message from the bank reminding her about her new rewards card and letting her know that she already has enough points for a companion ticket to Toronto.

New capabilities

Most of the technologies required in this scenario are available now, including beacon transmitters that can be mounted on billboards, buildings, and other structures for near-field communications; application programming interfaces (APIs) to handle the transfer of data across parties; and advanced analytics to optimize interactions with a customer. The forces enabling consumers to expect real-time engagement are unstoppable. Across the entire customer journey, every touchpoint is a brand experience—and the digital touchpoints just keep multiplying. To maximize their digital channels, banks will need to focus on improving their capabilities in discovery, design, and delivery.

Discovery: Build an analytics engine

Even in this era of big data and widespread digitization of customer information, some banks still lack a 360-degree view of the people who buy their products and services. They typically assess campaigns in isolation rather than in the context of the entire cross-channel consumer decision journey. Meanwhile, data are stored in disparate locations and legacy systems rather than in a central repository. Complicating matters further is the range and quantity of “unstructured” data out there—information about consumer behaviors and preferences that is captured, for instance, in online reviews, social-media posts, and bank logs of call-center interactions.

To get the full customer portrait rather than just a series of snapshots, banks need a central data mart that combines all the contacts a customer has with a brand—basic consumer data plus information about transactions, browsing history, and customer-service interactions. Tools such as Clickfox and Teradata can help banks gather these data from across disparate departments and begin to pinpoint opportunities to engage more effectively with customers. Using analytics applications such as SAS and R, and applying various algorithms and models to longitudinal data, they can better model the cost of their marketing efforts, find the most effective journey patterns, spot potential dropout points, and identify new customer segments. Additionally, by using business-process software and services, banks can identify in real time the basic “triggers” for what individual customers need and value and personalize their approach when reaching out with advice or cross- or upsell offers. Banks can also use these tools to generate automated reports that track customer trends and key performance indicators.

So the beacon detecting Diane’s presence in the airport via her mobile phone adds to the dossier of financial and behavioral information the bank has already collected on her. It knew that she used her current card to purchase plane tickets, and even though she may be a good candidate for other products the bank offers—say, a rollover IRA or a retail affinity card—the bank has prioritized “travel rewards” as the core message for Diane. It knows she has had a good relationship with the bank; she hasn’t been making regular withdrawals to other banks (presumably to pay off a competing card). The bank therefore sent her a friendly, direct offer, complete with a complimentary coffee. If circumstances had been different and a competing bank were involved, Diane’s bank could have quickly turned tail and prioritized a different message—one involving a series of pitches educating her about the benefits of a credit card from this bank versus the other. Similarly, when Diane used the Property Spotting app, the bank could offer just-in-time information about the local real-estate market, based on its understanding of her interests. All this thinking happened in real time, building on the data and segmentation rules the bank already had established.

Design: Create frictionless experiences

Careful orchestration of the consumer decision journey is incredibly complex, given the varying expectations, messages, and capabilities associated with each channel. According to published reports, 48 percent of US consumers believe companies need to do a better job of integrating their online and offline experiences. Digital natives such as Amazon, eBay, and Google have been leading the pack in resetting consumer expectations for cross-channel convenience—think of eBay’s Now mobile app, which provides one-touch ordering from any of its retail partners and same-day delivery in some US cities; or Amazon’s inclusion of a help button in the company’s latest-generation Kindle Fire tablet, linking users to a live help-desk representative. Some leading-edge financial institutions are similarly focused on creating frictionless online and offline experiences, but most have not gotten to the point of integrating themselves into their customers’ daily lives through digital.

There are inevitable privacy and security concerns to tackle, of course, but digital natives are exploring opportunities to test new user experiences and constantly evolve their offers—often for segments of one.

This test-and-learn approach might sound counterintuitive to marketing organizations in large, entrenched financial institutions. It might challenge the architectures and rules that most banks already have in place. But test-and-learn methods are critical for helping banks decide how best to optimize (and customize) critical design attributes of the consumer decision journey at various points along the way. Everything that Diane is drawn to in the hypothetical example, for instance, happens seamlessly across offline and online channels and is completely customized for her situation—from the first contact in the airport through her mobile phone, to the landing page that compares the new card to her own, to the API that allows the bank to offer her a coffee from a regional vendor, and to all the other technology layers and interfaces that allow her to register her new card on certain commercial sites and to explore the local real-estate market. Rather than push what could be construed as intrusive (even creepy) messaging, the bank provided Diane with the most useful information at every point in her decision journey and the easiest possible path to purchase and delivery.

Delivery: Build a more agile marketing operation

Banks need to be able to support countless interactions like Diane’s every minute of every day; the speed, scale, and complexity can be staggering—especially when you consider that most marketing organizations in banks are geared toward slower-paced campaign management. Under the direction of conservative senior leaders, teams tend to launch campaigns focused on pushing single products at a time across a range of channels. But is pitching that one product really the best interaction a bank can have with a customer? Maybe the customer has already seen an ad for a credit card several times, has not responded, and is clearly not interested. Maybe the customer recently had a bad service interaction at a branch, and confidence needs to be restored. In both cases, other actions and offerings, and a consideration of which messages and experiences take priority over others, would likely be more effective.

Banks must find ways to be more agile—in their mind-sets and their marketing operations. They must be willing to conduct a lot of small-scale experiments involving a variety of products and third-party providers (retailers, for instance) using cloud or proxy website services to pilot new designs and prove their value for investment. These activities must be supported by a marketing organization that has the right people, tools, and processes. Indeed, the most successful bank marketers we’ve seen have established centers of excellence in both analytics and digital marketing, and they have practiced end-to-end management of microcampaigns. Their campaign-building processes typically include systematic calendaring, brainstorming, and evaluation sessions to allow for one-week and two-week turnaround times. And roles and responsibilities are clearly defined. Far from creating a rigid, hierarchical process, this model frees up individuals to iterate quickly—what is sometimes called “falling fast forward” in the world of high tech.

At one bank, for instance, business-unit leaders gather each month to talk about their progress in improving different consumer journeys. As new products and campaigns are launched, the team places a laminated card illustrating the journey at the center of the conference-room table and discusses its assumptions about the flow of the experience for different segments and how the various functional groups need to contribute: Where does customer data need to be captured and reused later? How will the design of the campaign flow from mass media to social media and then to the website? What is the follow-up experience once a customer sets up an account? The team has also appointed dedicated mobile and social-media executives to become evangelists for strengthening the omnichannel experience, helping business units raise their game along a range of consumer interactions. The company’s first wave of fixes and new programs generated tens of millions of dollars in the first six months, and the team expects it to continue scaling beyond $100 million in added annual margins.

Building an agile marketing organization will take time, of course. Banks should start by assembling a “scrum team” incorporating a range of cross-functional perspectives (marketing, IT, channel management, finance, and legal). Its members must adopt a war-room mentality—for instance, making tough calls about which campaigns are working and which aren’t; which messages should take priority for which customer segments; launching new tests every week rather than every six months; and mustering the IT and design resources to create content for every possible type of interaction.

New skill sets and types of information systems will likely be required. The best technology solutions will vary according to the bank’s starting point and objectives. Generally, though, financial institutions will get the best results from tools that enable large-scale data management and the integration of databases; the generation of next-best-action and other types of advanced analyses; and simpler campaign testing, execution, and metrics.

To mobilize their marketing organizations for the challenges ahead, banks must embrace the 3-D capabilities associated with revenue enhancement through digitization. Already, the banks that are investing in data, design, and delivery have seen significantly improved click-through rates and higher conversion rates—between three and ten times the average—and are launching new products in far less time. This approach will demand a pivot in thinking about online channels: they can no longer simply be considered in isolation and as a tool for cost containment. Instead, banks need to make strategic decisions about how to choreograph their marketing and sales activities across online and offline channels, providing a seamless, engaging experience that offers the most value to customers—and prompts them to return again and again.

Monday 30 March 2015

Keeping Up with Evolving Business Processes

Keeping Up with Evolving Business Processes

By Tom Murphy | Dec 8, 2014

About a dozen years ago, many companies adopted rolling budgets as a way to update their financial outlook constantly instead of waiting for the end of the quarter or year. Essentially, they viewed each new month as the start of a new year, allowing them to adjust to the future based on trends of the recent past.

About a dozen years ago, many companies adopted rolling budgets as a way to update their financial outlook constantly instead of waiting for the end of the quarter or year. Essentially, they viewed each new month as the start of a new year, allowing them to adjust to the future based on trends of the recent past.

Ah, the good old days. Today things move much faster, not just with budget planning but with virtually every business process in almost every large company.

John Burton, CEO of Nintex, argues that this evolution in business processes stems largely from the explosion in unstructured data that allows teams of employees to react to new data, the needs of mobile workers, price changes, social media or other factors that come into play.

CMSWire asked him to share his point of view from the helm of a company that creates workflows for about 5,000 clients.

CMSWire: Are business processes going away or are they evolving into something new?

Burton: I think there is a significant evolution of business processes. In most companies they were transactional, and by that I mean they were repetitive, high-volume types of transactions that were under the control of IT. The other processes that needed to take place to support professional workers — office processes and others — were left for second or third priorities because they were very, very challenging to try to automate.

The reason there's a big change now is because there is a massive increase in the amount of unstructured data that is included or required for a business process. That includes things like documents, records, forms, but now even video, social feeds, social notification and mobile input. All that stuff is unstructured. The difference between what is required today versus what had been automated in the past is you've got to find a way to get all that stuff to work in a coordinated, automated fashion, feeding all the people who collaborate in a particular process that in itself may be unstructured.

CMSWire: How is this manifesting itself in the workplace? Are we seeing different technologies, or different work routines?

Burton: I think the old thing about "always on" is prevalent. You're mobile right now. All of us who are traveling are dealing with processes and approvals for systems, provisioning, collaborating with a bunch of people, and you may be at any number of locations. Plus you may be doing it with a social tool like Yammer, you may be using Twitter, and at the same time, you may be interfacing with a SaaS application at your company. So there are different types of systems that feed and expect responses, different business approval and provisioning requirements and it can be global in nature. So, absolutely, it's new devices, new technologies and a lot of them require instant responses.

CMSWire: When we consider business processes that are essential to the smooth running of the business, how is this change affecting those? Are we revising business processes to include this new mobile era with new devices? Or are they actually supplanting the processes with new ways of doing business?

Burton: I think to a large extent, the corporate IT-controlled applications that are transactional and structured in nature continue to evolve. Think about Workday, Salesforce, ServiceNow. But at the same time, the demands to automate those processes that use unstructured content that are [used for] approval, provisioning, mobile data capture, mobile data dissemination, social feeds are the ones that are required to be automated because they need to be compliant, governed, accurate and immediately responsive.

So think about data of an unstructured nature being contained in SharePoint or a file sync and share system with mobile or social feeds interacting with it. The only way to really automate it is to define a flow of work with content that gets assimilated in that workflow, and then define the people who interact with that workflow process. It's a different way of looking at things because it's not a data value. It's content as opposed to data.

CMSWire: This reminds me of the discussions of rolling financial budgets. What I'm hearing is that the business process of yesterday is becoming a living organism in today's workflow. Is that a fair statement? And if so, how does that affect information governance?

Burton: That's a great way to put it. I may steal it! Let's take an example. Let's say a company is public and needs to do a quarterly filing. Every company does a filing that is done quarterly as a document. It's a 10-K or a 10-Q that gets filed with the SEC. And it gets circulated internally to the CFO, the marketing staff, the CEO and the lawyers. And every time it goes through revision, it needs to be approved and sent to the next person in the sequence or concurrently. That is a living, breathing document — everyone doesn't collaborate on it, but they need to approve and sign-off. Before it gets filed, that document needs to be approved by a certain number of people and then sent. That absolutely needs to be done in a compliant process that can be tracked, that can be recreated if necessary. All the data values and words need to be approved and they need to be done in a certain way. That's a simple example of something.

Sunday 29 March 2015

Five Reasons the Telecommunications Industry Needs Process Excellence

Due to consumers expecting more, being willing to take their money where they can get better service, and trends within the industry itself, the telecommunications sector needs process excellence more than ever. Here are five reasons why.

Reason #1: Increasing competition

Competition in the industry is growing – and not just from the traditional players.

Internet traffic is playing a greater role in communications, with 50 to 70 percent

annual growth rates, and is far outpacing voice telephony, Engineering News reported

last year.

Dr Tingye Li, an optical communications researcher, told the publication: “The

landscape in telecoms is changing. It’s changing because people like Google are

putting themselves in the centre. The telecoms companies are on the periphery.”

With margins being squeezed, efficiency is essential and process excellence helps

remove non-value added activities, which will have a positive impact on the bottom

line.

Reason #2: The whole industry is on a burning platform

The now infamous burning platforms memo released by Nokia chief executive officer

Stephen Elop last year (if you haven’t read it you can read the text on the WSJ) is a

lesson to all in the sector about the importance of staying at the cutting edge of the

market.

Missed opportunities when the smartphone market was developing mean the

company is now playing catch up to the likes of Google and Apple.

Firms like Nokia which find themselves behind the curve can benefit hugely from

having experienced process improvement teams in place to ensure operations – and

the finished product – do not suffer if quick changes in direction are needed.

Don’t be left hanging around while the market moves on.

Those at the top of their game should see it as an investment for their future, allowing

them to stay in their prime position.

Reason #3: Customer satisfaction is a key differentiator

Research has consistently shown that consumers are willing to pay more to receive good customer service. For companies which achieve good customer satisfaction, like Apple, the results really speak for themselves.Process excellence can act as the differentiator which separates your company from others in the sector.

Recent customer satisfaction figures released by the UK regulator Ofcom shows

little differences in the scores for the biggest mobile phone operators, with just three

percentage points separating the top five.

With around 20 percent expressing neutral sentiment, and just two percentage points

separating those in the top five in this area, there are clearly customers there to be

won over by excellent customer service. Process excellence is one way in which to

ensure this is achieved.

Apple is a shining example for how customer satisfaction pays off in terms of sales.

Speaking after Apple topped the J.D. Power and Associates’ smartphone customer

satisfaction rankings for the fifth time, Kirk Parsons, senior director of wireless

services, said: “It really is Apple, and then the next tier.”

Reason #4: Fast pace of innovation

Although what you do is important, making sure you not only do the right things but

that you do things right has perhaps never applied more to the telecommunications

sector. The telecommunications sector is one where last year’s model and services

feels outdated and three years is practically ancient history. Companies which

develop new ways of doing things – and do these things well – will be the ones that

succeed in the longer term.

Reason #5: Mergers and Acquisitions

Google’s acquisition of Motorola last year typifies what is occurring in the

telecommunications industry in a number of ways. As a relatively new player, Google

has now set itself up in a place of dominance to tackle established market members

and has feelers in numerous sections of the industry.

Yet the cultures of the two organisations are incredibly different, and this is where

process excellence has a role to play in the M&A process.

The Wall Street Journal reported that the pair’s very diverse offerings inherently

create variations in the way the companies have worked. Sanjay Jha, chief executive

of Motorola Mobility Offerings, explained if he was at Google and “wrote a little bit of

code, and if there are bugs, I can fix it later.”

“When I deliver a phone, I don’t have that flexibility,” he added.

Labels:

Process Improvement

Saturday 28 March 2015

Plan-Do-Check-Act (PDCA)

Implementing New Ideas in a Controlled Way

Also known as the PDCA Cycle, or Deming Cycle

Create a model before you build the final solution.

© iStockphoto/suprun

Something needs to change: Something's wrong, and needs to be fixed, and you've worked hard to create a credible vision of where you want it to be in future. But are you 100% sure that you're right? And are you absolutely certain that your solution will work perfectly, in every way?

Where the consequences of getting things wrong are significant, it often makes sense to run a well-crafted pilot project. That way if the pilot doesn't deliver the results you expected, you get the chance to fix and improve things before you fully commit your reputation and resources.

So how do you make sure that you get this right, not just this time but every time? The solution is to have a process that you follow when you need to make a change or solve a problem; A process that will ensure you plan, test and incorporate feedback before you commit to implementation.

A popular tool for doing just this is the Plan-Do-Check-Act Cycle. This is often referred to as the Deming Cycle or the Deming Wheel after its proponent, W Edwards Deming. It is also sometimes called the Shewhart Cycle.

Deming is best known as a pioneer of the quality management approach and for introducing statistical process control techniques for manufacturing to the Japanese, who used them with great success. He believed that a key source of production quality lay in having clearly defined, repeatable processes. And so the PDCA Cycle as an approach to change and problem solving is very much at the heart of Deming's quality-driven philosophy.

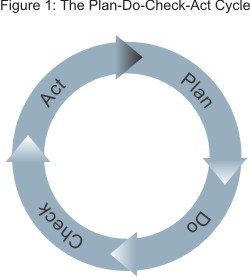

The four phases in the Plan-Do-Check-Act Cycle involve:

- Plan: Identifying and analyzing the problem.

- Do: Developing and testing a potential solution.

- Check: Measuring how effective the test solution was, and analyzing whether it could be improved in any way.

- Act: Implementing the improved solution fully.

These are shown in Figure 1 below.

There can be any number of iterations of the "Do" and "Check" phases, as the solution is refined, retested, re-refined and retested again.

How to Use the Tool

The PDCA Cycle encourages you to be methodical in your approach to problem solving and implementing solutions. Follow the steps below every time to ensure you get the highest quality solution possible.

Step 1: Plan

First, identify exactly what your problem is. You may find it useful to use tools like Drill Down, Cause and Effect Diagrams, and the 5 Whys to help you really get to the root of it. Once you've done this, it may be appropriate for you to map the process that is at the root of the problem.

Next, draw together any other information you need that will help you start sketching out solutions.

Step 2: Do

This phase involves several activities:

- Generate possible solutions.

- Select the best of these solutions, perhaps using techniques like Impact Analysis to scrutinize them.

- Implement a pilot project on a small scale basis, with a small group, or in a limited geographical area, or using some other trial design appropriate to the nature of your problem, product or initiative.

Our section on Practical Creativity includes several tools that can help you generate ideas and solutions. Our section on Decision Making includes a number of tools that will help you to choose in a scientific and dispassionate way between the various potential solutions you generate.

Note:

The phrase "Plan Do Check Act" or PDCA is easy to remember, but it's important you are quite clear exactly what "Do" means. ""Do" means "Try" or "Test". It does not mean "Implement fully." Full implementation happens in the "Act" phase.

Step 3: Check

In this phase, you measure how effective the pilot solution has been, and gather together any learnings from it that could make it even better.

Depending on the success of the pilot, the number of areas for improvement you have identified, and the scope of the whole initiative, you may decide to repeat the "Do" and "Check" phases, incorporating your additional improvements.

Once you are finally satisfied that the costs would outweigh the benefits of repeating the Do-Check sub-cycle any more, you can move on to the final phase.

Step 4: Act

Now you implement your solution fully. However, your use of the PDCA Cycle doesn't necessarily stop there. If you are using the PDCA or Deming Wheel as part of a continuous improvement initiative, you need to loop back to the Plan Phase (Step 1), and seek out further areas for improvement.

When to Use the Deming Cycle

The Deming Cycle provides a useful, controlled problem solving process. It is particularly effective for:

- Helping implement Kaizen or Continuous Improvement approaches, when the cycle is repeated again and again as new areas for improvement are sought and solved.

- Identifying new solutions and improvement to processes that are repeated frequently. In this situation, you will benefit from extra improvements built in to the process many times over once it is implemented.

- Exploring a range of possible new solutions to problems, and trying them out and improving them in a controlled way before selecting one for full implementation.

- Avoiding the large scale wastage of resources that comes with full scale implementation of a mediocre or poor solution.

Clearly, use of a Deming Cycle approach is slower and more measured than a straightforward "gung ho" implementation. In true emergency situations, this means that it may not be appropriate (however, it's easy for people to think that situations are more of an emergency than, in reality, they really are...)

Note:

PDCA is closely related to the Spiral Development Approach which is popular in certain areas of software development, especially where the overall system develops incrementally. Spiral Development repeats loops of the PDCA cycle, as developers identify functionality needed, develop it, test it, implement it, and then go back to identify another sub-system of functionality.

Key Points

The Plan-Do-Check-Act (PDCA) Cycle provides a simple but effective approach for problem solving and managing change, ensuring that ideas are appropriately tested before committing to full implementation. It can be used in all sorts of environments from new product development through to marketing, or even politics.

It begins with a Planning phase in which the problem is clearly identified and understood. Potential solutions are then generated and tested on a small scale in the "Do" phase, and the outcome of this testing is evaluated during the Check phase. "Do" and "Check" phases can be iterated as many times as is necessary before the full, polished solution is implemented in the "Act" phase.

SOURCE: Mindtools.com

SOURCE: Mindtools.com

Friday 27 March 2015

How to Cash In on Business Process Improvement

A primary motivator behind any attempt at Business Process Improvement (BPI) or systems upgrades is to see measurable and tangible results. These results may include reduced operating costs, fewer errors/defects, improved customer satisfaction, cycle time or profitability. The average Business process contains about 80% non-value added activity. This translates to a potential “Gold Mine” of opportunities for most manufacturing, service delivery or government organizations. Focused attempts to increase the efficiency of workflows may net a 60% reduction in steps with corresponding reductions in cycle time. Similar savings projections are not uncommon for automated systems. These bottom line results would warm the cockles of any senior executive’s heart.

Unfortunately, actual experience reveals that CEOs and CFOs frequently are repeatedly frustrated by investing time and money in hardware, software or consultants, hearing pie-in-the-sky promises only to realize little if anything during post-implementation analysis. Yet when intelligent and reasonable people logically examine the improved system, the savings should be real. This article describes what has happened to the projected savings that seem to evaporate after a process has been improved or the automated system put in place. The piece will also explore what can be done to realize these benefits before they disappear.

Back in the days of the “Efficiency Expert” the issue was fairly simple and clear cut. If the improved system could save the equivalent of ten full time employees, you got out the old meat axe and lopped ten hard working loyal people from the organization’s payroll. While this approach was straight forward, it was not without draw backs. Staff experiencing these purges fell into 2 categories. The first group is composed of the “Victims.” These people did nothing wrong yet paid a very high price for organizational inefficiency. They are gone and so are their skills and experience. The second group of staff is called the “Angry Survivors.” “Angry Survivors” saw what happened to their friends and teammates, wondering when it will be their turn. Loyalty to the organization is gone. Future attempts to optimize operations will be met with passive aggressive and overt resistance.

So conducting an immediate reduction in force is a definite approach to get bottom line savings. However, it is tantamount to Continuous Improvement suicide and is not a wise option. Some organizations realize this and take a more humane approach by using attrition to achieve the savings that would be produced by a reduction in force. This option is flawed for two reasons. First, attrition is random unless there is a targeted “Golden Parachute” incentive. Random attrition may not get you the savings in the places where the improvements occur. Reshuffling the human resource deck is not always a good or practical option. The other problem with attrition is that it takes time. When a process has been improved through the elimination of large amounts of time and waste, staff resources have been given the gift of additional time. If the organization waits several months for attrition to occur the organization will probably have to back fill the positions. People will be busy with no time to spare. Savings projected with the implementation of the improved process or system seems to have vanished over a short period of time. It is as if someone places his/her hand in a pond. Even though the hand displaces water when the person’s hand is withdrawn the waters close as if the hand were never there.

So how can the organization cash-in on these promised savings without destroying the morale and loyalty of the workforce? There are several techniques that we will explore. The first evolves from a brilliant and witty British Professor, Cyril Northcote Parkinson. Parkinson gives us a simple but powerful concept that has become known as “Parkinson’s Law.” Simply stated, “Work expands to fill the time available for its completion.” As a Business Process Improvement consultant with 33 years experience, I have seen Parkinson’s Law validated time-and -time again. At the beginning of my career I had a client that was in the disability insurance business. The organization was about to undergo a significant expansion due to the acquisition of a new program. In what appeared to be good prior planning the organization hired about 20 new professional staff to process the projected workload. The Claims Examiners were hired well in advance of the start of the new program. The game plan was to train the new staff and let them function with a reduced caseload for six months. The normal caseload was 100 pending claims. Experienced Claims Examiners could handle this workload comfortably. After training, the new staff would receive intake until the caseload peaked at 25. The caseload would be maintained at that level for four months then gradually increased to 100 by the 6th month. Knowing the workings of “Parkinson’s Law”, I strongly advised the leadership of the organization against this strategy. My advice was disregarded and 25 pending claims became a full caseload for the new Claim Examiners. It was not because the new hires were lazy or lacking in skills, intelligence or motivation, it was “Parkinson’s Law” in action.

Lack of understanding of “Parkinson’s Law” causes many great process improvement initiatives and systems upgrades to come apart at the seams. Any operational improvement will eliminate non-value-added activity or automate manual duties. If we fail to substitute high-value added activity for the eliminated tasks “Parkinson’s Law” comes into play and any gains made via improved efficiency are lost to the inexorable mechanics of Parkinson. Accordingly, when savings are first projected through the improved system or workflow we must identify them and “Repurpose” the time made available through the improvement. In other words we are substituting high value activities for non-value added or obsolete activities. This should be done deliberately using a planning tool with a very short timeline.

Planning for Parkinson’s Law should be integrated into an organizations Continuous Improvement methodology. Let’s examine an organizational Business Process Improvement Model and see how Parkinson’s Law can be blended in to make the model produce tangible savings every time. Here is a typical 7-Step model:

- Preparation - A process is selected and defined with a project charge statement.

- Documentation - The “Present State” process is captured in detail to include baseline metrics.

- Analysis - A wide range of improvement possibilities is considered.

- Synthesis - Options are evaluated against deliverables described in the project charge statement and one or more improvement scenario(s) is adopted as the “Future State” process.

- Acceptance - The improved process proposal is presented to management. Management decides which elements will be implemented.

- Implementation - The improvements are put in place and the improved workflow is standardized.

- Continuous Improvement - Key metrics are identified and continuously measured to ensure the ongoing health of the new process. The workflow is reviewed on a regular basis to identify additional opportunities from efficiency and effectiveness perspectives. This time tested approach will usually produce substantial and measurable results when harnessed to effective BPI tools. However, one key element is missing, an antidote for “Parkinson’s Law”. Without this additional step the waters will close shortly after Implementation and all savings will be lost. Consider adding an eighth step to the model that is described above. Insert it between steps IV (Synthesis) and V (Acceptance). Let’s call this step “Reallocation of Resources”.

During the “Reallocation” step resources that have been “Freed-Up” through the elimination of waste are “Repurposed”. The trick is to immediately substitute high value added activities for non value added activities. This can be accomplished in two ways both of which may benefit the organization. Selecting the best option or combinations of options should be driven from a situational perspective. The two options are: - The “Wish List” Option - Every organization has a list of things that they could do to move the company towards “World Class Status” or to improve competitiveness or customer satisfaction,” IF ONLY WE HAD THE RESOURCES”. The “Wish List” will not contain waste or non value added activities but rather high value the things the organization should be doing. Develop a “Wish List” for your organization with an activity involving top management. Get the customer’s perspective by repeating the session with them or inviting the customers to management’s “Wish List” meeting. Develop the list by brainstorming “Things we could do to improve the organization if we had unlimited human resources”. Next, sort the list by the functional departments of the organization and prioritize each functional list. When you have freed resources visit the “Wish list” for high value added “Repurposing”.

- Increased Capacity Option - If there is a great demand for your products or services that the organization has been unable to meet or if you wish to increase your market share, this option may be for you. After the non value added activities have been removed from the process don’t stop there. Reconfigure and /or redeploy existing resources to maximize production capacity. It must be studied and planned for. It will not happen under its own steam.

After the “Reallocation of Resources” decisions have been made they should be incorporated into the Improvement Project Proposal and delivered to management. Subsequent implementation of improvements should be done using project planning tools. The implementation plans should include the action items that describe reallocation of resources.

Sarasota County Case Study

Sarasota County government has been a longstanding proponent of customer service and continuous improvement. Every building county building proudly proclaims Dedicated to Quality Service.” These are not just plaques on the entryways of public buildings. These words are backed up by actions and a solid commitment from management at all levels.

In 1996 Jim Ley, County Administrator, trained staff in Continuous Improvements and launched several highly successful process improvement projects. Subsequently, the county adopted a “Work Simplification” based methodology. Sarasota County deployed Continuous Improvement through a formalized structure and trained internal trainers to grow the program in a cost effective manner. The County has wisely integrated Continuous Improvement with Strategic Planning initiatives. This gave rise to an interesting and proactive project launched by Karen Rushing, Clerk of the Circuit Court and Sarasota County Comptroller and Pete Ramsden, The Director of Finance. Mr. Ramsden had been involved with the County’s Continuous Improvement program from the outset. He was a member of one of the first teams trained and chartered by the County. Pete had effectively used process improvement techniques with his Finance work team to harvest much of the low hanging fruit.

Southwest Florida has experienced very strong growth for over 40 years. Projections through 2030 continue to show growth, which translates to an increased workload for Sarasota County. Rather than take the traditional passive approach and hire new workers as volume increased, Karen Rushing and Pete Ramsden had taken an aggressive and proactive tact that will delight county customers without adding additional staff. If successful this experiment would have transferability to processes County-wide.

The work flow targeted for improvement was Accounts Payable. The “Present State” process worked well with a very short cycle time, happy customers and a talented Accounts Payable staff. The goal of the project was to optimize the Accounts Payable work flows to generate sufficient capacity to accommodate the predicted increase in workload with the existing staffing level.

Sondra Knapp, Accounts Payable Manager was the project coordinator for the process improvement study which documented all departmental processes. Analysis and synthesis yielded a projected 25% increase in capacity. These improvements are very modest by BPI standards. The relatively small improvement percentage was due to the fact the workflows had been optimized several times in recent years. None the less a 25% capacity increase is substantial and well worth pursuing.

Improvements fell into three categories. The categories include:

- Process Mechanics: The existing process was changed by steps being eliminated, combined, re-sequenced, done in a different place, done by a different person, automated or improved. Many of these changes would be done on a pilot basis to avoid the sting of another Law, “Murphy’s”.

- Compliance Improvement: The study revealed a high number of requests for payment were submitted incorrectly or incompletely by internal and/or external suppliers of process inputs. This caused an inordinate number of delays and time dedicated to avoidable rework. All agreed that a multifaceted outreach and education program would greatly improve compliance with existing process requirements.

- Workplace Redesign: Moving office furniture and equipment would compliment the optimized work flows by improving visibility, reducing distances traveled and improving accessibility to equipment and materials needed to do the job.

This is the point in the project where decisions must be made that will affect the bottom line outcome of the project, reallocating existing resources. Sarasota County evaluated their options and chose well. Reducing the existing workforce was never a viable consideration. The idea of releasing hardworking, well trained and motivated workers only to rehire inexperienced people a few months later made no sense at any level. The County leadership was well aware of Parkinson’s Law. Management was determined not to lose hard earned capacity increases to Parkinson. Accordingly, a plan was initiated that would keep the Accounts Payable staff meaningfully engaged with project implementation tasks.

Sondra Knapp was responsible for implementing the myriad of improvements. She has broken the improvements into a series of projects. Each project is formatted as a Gantt chart. Sondra engaged the Accounts Payable staff in the interesting work

associated with project implementation. Project tasks include:

associated with project implementation. Project tasks include:

- Designing, scheduling and delivering training programs to suppliers of process inputs.

- Writing a Users’ Manual for Purchasing Card holders.

- Developing, publishing and distributing informational materials to internal and external process suppliers.

- Working with County Audio/Visual staff to script, produce and deploy a series of video based compliance aids.

- Redesign the existing office space.

- Assessing and installing Contract Management Software.

- Designing, implementing and assessing the results of a number of process redesign pilot projects.

- Working with existing Systems suppliers to optimize and integrate electronic operations

- Developing “New Vendor and Contract Bid” kits.

There was plenty of work involved with project implementation. The AP Staff would experience full days even though much non value added activity had been removed from their jobs. As projects wind down the workload will increase as projected. Parkinson’ Law will be thwarted.

Sarasota County provides an excellent example of a “Process Mature” organization using BPI in a proactive and effective manner. Actively planning for Parkinson’s Law gave the organization the much needed human resources to implement the extensive projects initiated during the process optimization effort. Events were timed so that the new workload would gradually materialize as project implementation tasks gradually subsided.

SOURCE: www.corpedgroup.com

Subscribe to:

Posts (Atom)